Track

Imagine a world where financial decisions, once guided by intuition and experience, are now influenced by a force: data science. In finance, a revolution is unfolding, one algorithm at a time. It's a realm with an unfathomable amount of data. Over 2.5 quintillion bytes of information are generated per day, and within this sea of numbers and patterns lies the future of finance.

Gone are the days when finance was about numbers on a spreadsheet. Today, it resembles a cutting-edge treasure hunt where data scientists with tools dive into data to uncover invaluable insights. From predicting market trends to detecting activities, data science is reshaping the essence of financial operations.

Curious to get started on your own data science in finance journey? Check out DataCamp’s Finance Fundamentals in Python skill track, which covers the essential skills needed to make data-driven financial decisions. You can also view our webinar on How Data Skills are Changing the Future of Finance to learn more.

Elevate Your Finance Team's Data Skills

Train your finance team with DataCamp for Business. Comprehensive data and AI training resources and detailed performance insights to support your goals.

How Is Data Science Used in Finance?

Let’s start by looking at the areas where data science is used in the finance industry. These are some of the broad ways in which data insights can benefit those in finance:

1. Risk Management: The Oracle of Finance

Imagine a seer gazing into the future, foreseeing storms on the horizon. Data science in finance plays this role, peering through the mists of market data and customer behavior to predict risks. It's like having a financial weather forecast, helping companies prepare umbrellas for rainy days and sunscreens for sunny markets. Such financial risk management can be highly useful.

2. Algorithmic Trading: The Speedster of the Stock Market

Data science is the turbocharged engine driving decisions in the high-octane trading race. Like a race car driver relying on a team of experts for the best strategy, traders use algorithmic trading to make swift, intelligent moves. Armed with data, computers are the pit crew, making split-second decisions that keep traders ahead in the race.

3. Fraud Detection: The Financial Detective with a Data Magnifying Glass

"In the world of finance, not all is as it seems. Data science steps in as the detective, scrutinizing every transaction with a keen eye. By analyzing spending patterns and account behavior, it spots the odd ones out – the financial villains trying to sneak past unnoticed." - Mark Varnas, Principal SQL Server DBA at Red9.

4. Regulatory Compliance: The Rule-Keeping Guardian

Navigating the maze of financial regulations is a Herculean task. Data science in finance is the guardian, ensuring institutions don't stray from compliance. It's like having a regulatory compass, pointing businesses toward legal safety.

Benefits of Using Data Science in Finance

So, we’ve some of the ways we can use data science in finance, but what are the advantages that this approach brings? As you might expect, there are several:

Navigating Risk; Exploring a Maze with a Compass

Imagine finding yourself in a labyrinth of financial risks, where danger lurks at every turn. Data science acts as your compass, illuminating the way whenever hazards are nearby. With each swirl of data, it reveals safe paths, transforming risky routes into secure passages.

This magical compass not only predicts dangers, but also turns uncertainty into a well-guided adventure, making the complex world of finance feel as comfortable as strolling through a well-lit park.

Uncovering Fraud; The Financial Detective in Action

In the corners of finance, fraud hides like a cunning fox. Fear not! By harnessing the power of data science in finance we equip ourselves with a Sherlock Holmes armed with a magnifying glass that uncovers even the tiniest anomalies.

Each algorithm is finely tuned to detect irregularities and serves as a clue, leading us to the lair of these deceptive tricksters. Just imagine having this data-driven sleuth on your team exposing fraudulent trails long before they can vanish into thin air.

Crafting Personalized Financial Narratives; Tailored Just for You

Welcome to a realm where your financial journey unfolds like a bespoke story crafted exclusively for you.

Data science creates a captivating tale of your journey, where every service and recommendation is customized to suit your unique story. It's like having a financial guardian angel who fulfills your wishes perfectly aligned with your dreams and aspirations. Such data storytelling is a valuable skill, communicating data insights in a way that’s understandable to all.

The Wise Counselor of Data; Navigating Your Financial Voyage

Data science plays the role of a counselor amidst the unpredictable seas of financial decisions, guiding your ship through both turbulent markets and tranquil waters. Its insights act as a guiding lighthouse, piercing through the uncertainty and assisting industry leaders in steering towards the shores of prosperity. In this realm, decision-making transforms into an enlightened expedition rather than a blind pursuit.

Real Time Analytics; Your Financial Intuition

"With data science, the world of finance gains a sixth sense that perceives the rhythm of markets in real time. It's akin to having a vigilant financial hawk soaring above its keen eyes capturing every ripple in the economic ocean and relaying signals to you for precise dives or majestic ascents, at just the opportune moment." - Bruce (Mingchen) Chi Co-founder, CEO of SuretyNow.

Automation; The Devoted Guardians of Your Financial Realm

Envision an army of knights pledged to protect and serve your financial kingdom. Data science dispatches these warriors to tackle laborious tasks, steadfastly marching through mountains of data with unwavering commitment.

They work tirelessly to allow human intellects to concentrate on the overarching strategies, within the realm of finance.

Data Science Applications in the Finance Industry

We now know why data science is a crucial tool in the modern financial world, as well as some of the broad ways in which it’s used. But let’s take a closer look at some of the applications of data science:

Algorithmic Trading: The Speedy Geniuses of Wall Street

Picture a financial racetrack where algorithmic trading is the lightning-fast race car, zooming past human traders with its ability to analyze and act on market data at breathtaking speeds. It's like a chess grandmaster, thinking several moves ahead and making split-second decisions that capitalize on the slightest market changes. Learn more about Financial Trading in Python with DataCamp’s hands-on course.

Customer Sentiment Analysis: The Emotional Barometer

Jim Pendergast, Senior Vice President at altLINE Sobanco, explains, "Imagine data science as a savvy psychologist reading the collective mind of the market. By sifting through the vast sea of social media, news, and financial reports, it gauges the mood and trends, turning tweets and posts into valuable insights that can predict the next big wave in the market."

Check out DataCamp’s Sentiment Analysis in Python course to learn more about how customer sentiment is calculated and used.

Regulatory Compliance: The Vigilant Watchdog

Navigating the complex web of financial regulations, data science stands as the ever-watchful sentinel. It tirelessly monitors transactions and keeps businesses on the straight and narrow, ensuring they dance gracefully along the tightrope of legal requirements and avoid the pitfalls of non-compliance.

Predictive Analytics: The Crystal Ball of the Financial World

Data science here is like a seer gazing into the future. It uses past and present data to forecast market trends, helping to spot opportunities and dodge financial storms. It's the guiding star for businesses, shining light on the path to success amidst market uncertainties. Start developing your skills today with DataCamp’s Introduction to Predictive Analytics course.

Roles and Responsibilities of Data Scientists in Finance

We’re now familiar with the various uses of data in finance, but how does this translate to the skills and responsibilities of the professionals who make it all tick? Here’s how the role might look:

Unraveling Financial Enigmas

Anthony Martin, Founder and CEO of Choice Mutual, says, "Above all, data scientists, in the field of finance function as detectives. They utilize their expertise to sift through volumes of data (think colossal mountains!) in search of patterns and clues. They persistently question why certain phenomena occur and endeavor to predict outcomes. Their primary objective is to make complex financial information comprehensible and applicable to all."

Developing Innovative Tools and Models

These experts craft models and tools through computer programming (it's akin to their spellbook). These resources aid in predicting market trends, such as stocks that may rise or fall, or determining the likelihood of loan repayment. It's like constructing a time machine that grants glimpses into the future!

Facilitating Major Decision Making

Data scientists play a role in assisting businesses with decisions, often utilizing tools like an investment calculator. They transform the findings into reports and presentations to showcase their diligent work. These materials enable top-level executives to make informed choices regarding investment opportunities or effective money-saving strategies.

Ensuring the Safety of Money

"One crucial responsibility of data scientists, in the finance industry is to safeguard money. They develop systems for detecting any suspicious activities, such as attempted theft. It's akin to setting up a security mechanism to protect assets." - Stephan Baldwin, Founder of Assisted Living.

Maintaining Curiosity and Continuous Learning

Data scientists working in finance never cease their quest for knowledge.

Linda Shaffer, Chief People Operations Officer at Checkr, adds, "The financial landscape is constantly evolving, demanding their perpetual learning endeavors. They are always engrossed in reading, studying and acquiring proficiencies or should I say "skills" to stay at the forefront of their field."

Skills and Experience Required for a Financial Data Scientist

If you’re keen to start your career as a financial data scientist, you’ll need to know the skills to start developing. Here’s a quick rundown:

The Masters of Numbers: Experts, in the World of Mathematics

To start with, these individuals have a knack for working with numbers! They possess the skills to effortlessly translate data into insights using statistics and probability. It's as if they can speak the language of numbers, uncovering stories about trends and hidden truths.

Coding: Their Secret Decoding Tool

In their toolbox they have a skill for coding that's similar to a decoder tool. They utilize programming languages like Python to unlock the mysteries hidden within data. It's like having access to a treasure chest filled with information. DataCamp’s Python Fundamentals skill track is an excellent place to start.

Machine Learning: Their Predictive Crystal Ball

Machine learning acts as their crystal ball, allowing them to glimpse into the future. By mastering the application of machine learning in finance these experts can train their systems to forecast developments in stock markets, identify investments, and much more.

It feels like possessing a time machine that provides insights into financial trends.

The Eye of a Detective: Revealing Patterns

Every financial data scientist possesses a detective quality. With attention to detail, they meticulously analyze data, land can uncover clues within data and translate them into valuable insights that pave the way for financial success.

Storytelling: The Data Whisperer

What good is a mastery of data if one can't effectively communicate it? This is where their storytelling skills truly shine. They have the power to transform complex and technical data narratives into captivating stories that resonate with boardroom members. They are not analysts; they are like enchanters who breathe life into numbers.

Financial Knowledge: The Strategist

A true hero knows their battlefield inside out. For these warriors of data, having an understanding of the finance world is absolutely essential. It's like having a treasure map during a hunt—it guides them in creating data models and strategies.

Real-World Experience: The Training Montage

What would a hero be without a training montage? These individuals gain real-world experience in both finance and data, which serves as their training ground. Through internships, projects, and real-life challenges, they refine their superpowers, preparing themselves for the battles in Financeville.

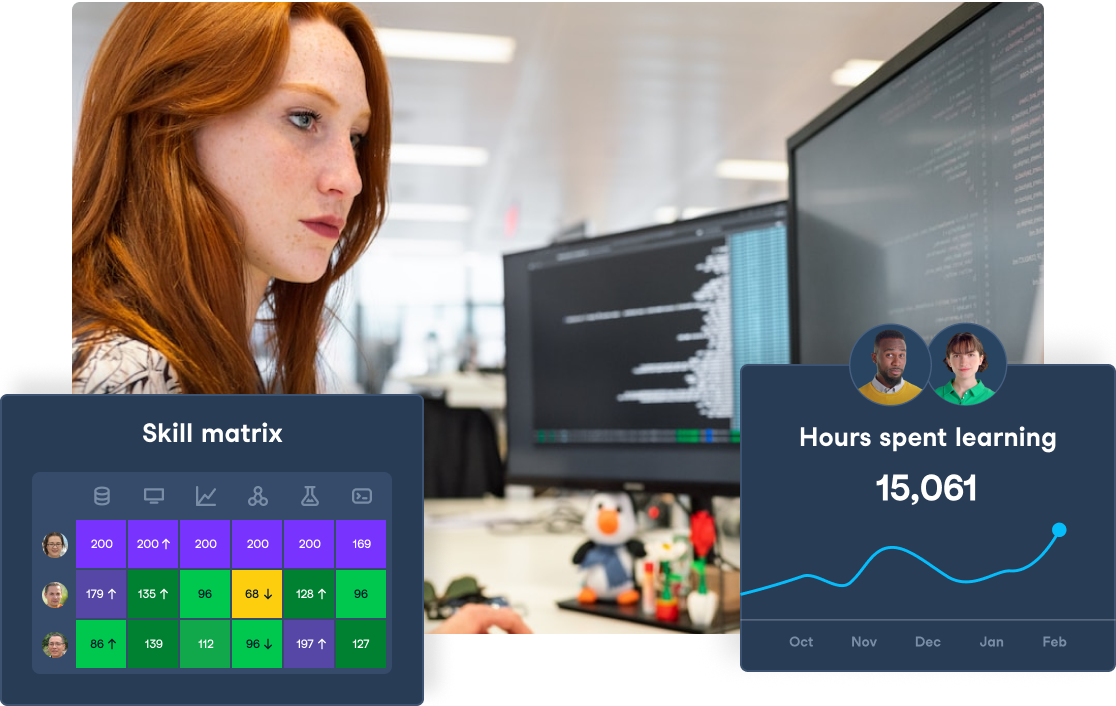

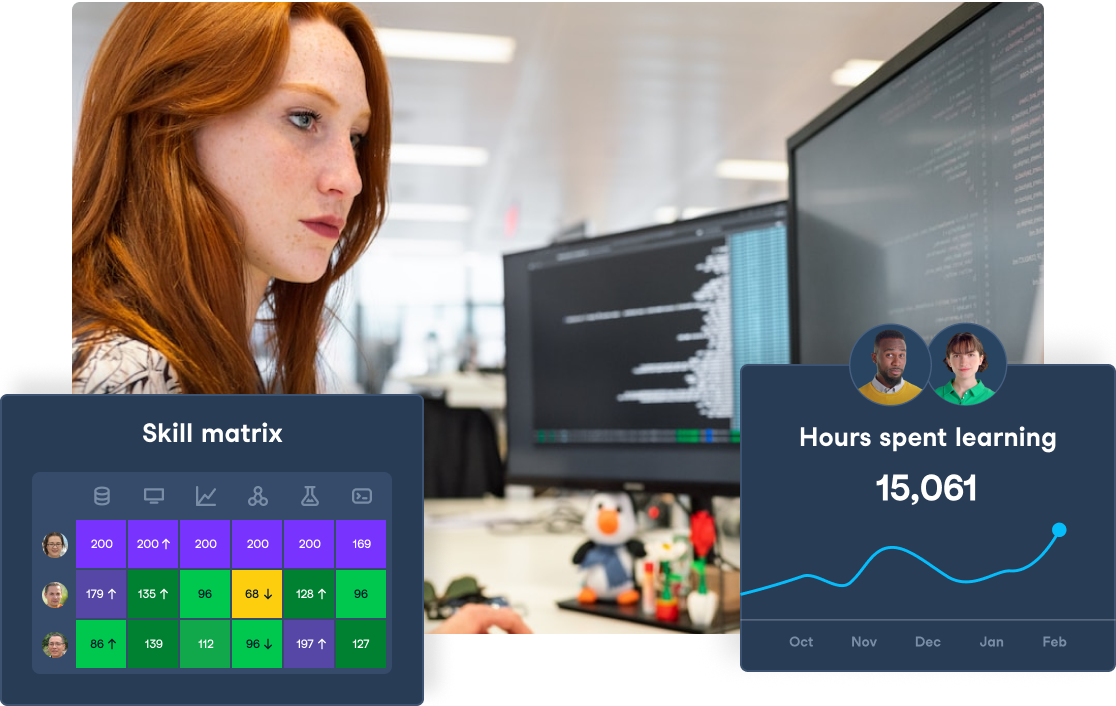

Upskill and Reskill with DataCamp for Business

DataCamp for Business empowers organizations to build the data skills required in finance. With tailored learning paths in Python, data analysis, and machine learning, your team can efficiently develop the technical skills needed for financial data science. By reskilling or upskilling your employees, your organization can stay competitive, leverage data insights, and drive smarter decisions.

Request a demo today to learn how DataCamp can provide a scalable learning environment that's customized to the needs and goals of your organization.

Conclusion

Diving into the world of finance nowadays, we're not just talking about numbers and charts - it's a whole new ball game with data science stepping onto the field. It's truly amazing to see how it's revolutionized the way we tackle financial decisions, manage risks, and even the way we serve up financial goodies. Using data science in finance isn't just a fad; it's a dynamic journey that keeps unfolding new and exciting paths.

The perks are like a breath of fresh air: laser-sharp risk assessment, a keen eye for sniffing out oddities, financial services that feel like they've been made just for you, and decision-making smoother than a well-oiled machine. Marrying these tech-savvy techniques with our deep-rooted financial wisdom is opening up a world of pinpoint predictions, operations running like clockwork, and fresh, creative solutions to those knotty financial conundrums.

At the heart of this evolution are the data scientists – the new-age heroes of the finance world. They’re a special blend, combining analytical sharpness, coding finesse, a deep dive into market trends, and a talent for making complex ideas as easy to grasp as your morning coffee.

Peering into the future of finance, it's crystal clear that data-driven methods are steering the ship. With technology moving at breakneck speed, we're all set to see even more refined and ingenious uses of data science in this vibrant sector. So, let’s embrace this journey with enthusiasm, ready to be amazed at where data can take us next in the ever-evolving world of finance!

Get started today with DataCamp’s Finance Fundamentals in Python skill track.

Advance Your Team's Data Science Skills

Unlock the full potential of data science with DataCamp for Business. Access comprehensive courses, projects, and centralized reporting for teams of 2 or more.